Discover the essential design patterns shaping the Fintech industry. Our comprehensive guide covers UI, UX, security, mobile apps, accessibility, and future trends, ensuring a user-friendly and secure financial technology experience.

Today, fintech users’ expectations are higher than ever. People demand the ability to complete tasks effortlessly, the assurance of robust security and compliance, and reliable and predictable outcomes in financial apps. Achieving this requires exceptional user experience (UX) design, which is critical in fostering a sense of security, transparency, and intuitive functionality. Significant expansion has occurred within the fintech industry. By 2030, it’s predicted to grow into a $1.5 trillion industry. These numbers indicate that there’s a growing demand for skilled UX designers. Why?

A well-crafted UX design not only assures users of the safety of their financial data but also ensures that the processes they engage with are straightforward and yield consistent results. This article explores the future trends in fintech design, highlighting how emerging technologies and design principles are set to meet and exceed these user expectations.

Introduction

The financial technology sector, commonly referred to as fintech, has experienced unprecedented growth in recent years, revolutionizing traditional banking and investment practices. This rapid expansion has led to a significant shift in how financial services are delivered and consumed, with fintech companies at the forefront of this transformation. As a result, these companies are increasingly focusing on creating user-friendly, secure, and visually appealing fintech application designs to drive business growth and market success. In this article, we will explore the key principles of fintech UX design, must-have features for fintech apps, and wealth management design patterns, providing insights into how these elements contribute to the overall user experience and satisfaction.

What is Fintech UX Design?

Fintech UX design refers to the process of creating user-centered design solutions for financial technology products and services. This involves a deep understanding of the needs and behaviors of fintech app users, ensuring that the interfaces are intuitive and user-friendly. The goal is to enable users to make informed financial decisions with ease. Fintech UX designers employ various techniques, including user research, wireframing, and prototyping, to craft seamless and engaging user experiences. By focusing on the user journey and addressing pain points, these designers help create applications that are not only functional but also enjoyable to use, ultimately fostering trust and loyalty among users.

Key Principles of Fintech UX Design

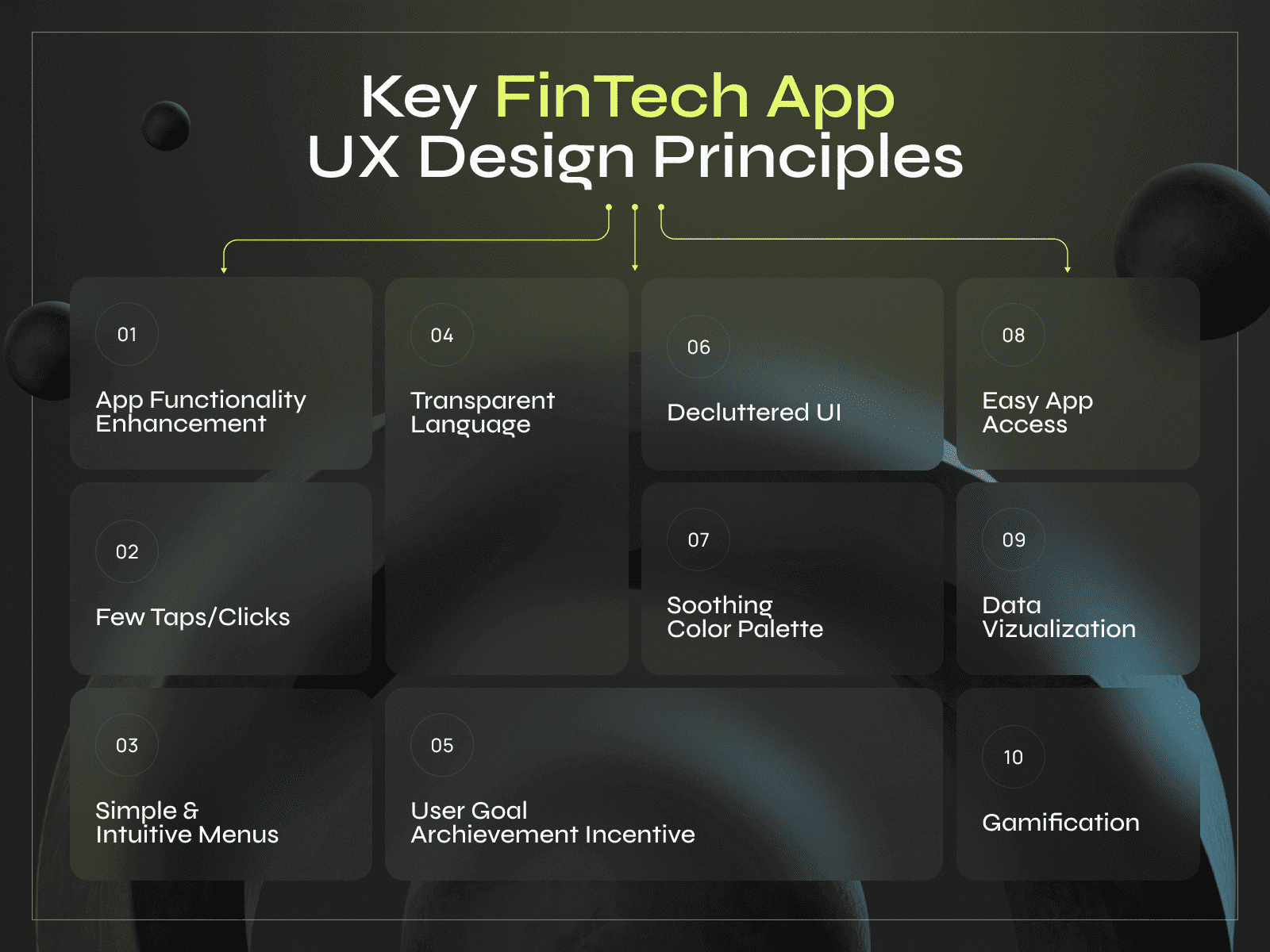

Effective fintech UX design is built on several key principles that ensure the creation of user-friendly and efficient applications:

- Simple and Intuitive Design: Fintech apps should have simple and intuitive interfaces that enable users to easily navigate and complete tasks. This involves minimizing complexity and ensuring that users can find what they need without unnecessary steps.

- Clear and Concise Language: Communicating complex financial information in a clear and concise manner is crucial. Fintech apps should use straightforward language to help users understand their financial status and actions without confusion.

- Secure and Reliable Financial Operations: Security and reliability are paramount in fintech. Apps must prioritize protecting user data and ensuring that financial transactions are conducted safely and accurately, fostering user trust.

- Personalization and Customization: Offering personalized and customized experiences based on users’ financial goals and preferences can significantly enhance user engagement. Fintech apps should adapt to individual needs, providing relevant insights and recommendations.

- Data Visualization and Insights: Providing users with clear data visualization and actionable insights helps them make informed financial decisions. Effective use of charts, graphs, and other visual tools can simplify complex data and highlight important trends.

By adhering to these principles, fintech companies can create applications that not only meet user expectations but also stand out in a competitive market.

User Interface (UI) Design Patterns

User interface (UI) design patterns play a crucial role in the fintech industry, shaping how users interact with financial applications and services. In comparison to other financial technology products, banking apps often feature traditional user interfaces that require careful design considerations to enhance user engagement. These design patterns are essentially reusable solutions to common design problems, ensuring consistency, efficiency, and usability across platforms. In fintech, where trust and clarity are paramount, effective UI design patterns help create intuitive and secure user experiences.

Key UI design patterns in fintech include clear and concise navigation structures, such as tab bars or side menus, allowing users to access different application sections easily. For example, the navigation design in apps like Revolut and PayPal ensures that users can swiftly move between accounts, payments, and transaction history without confusion.

- Forms, a common element in fintech apps for tasks like account registration or transactions, benefit from patterns that enhance usability and reduce errors. Inline validation and step-by-step progression, as seen in the onboarding process of apps like Robinhood, help users complete forms correctly and efficiently.

- Visual hierarchy is another critical design pattern, ensuring that important information, like account balances or transaction alerts, is prominently displayed. Apps like Mint use color contrast and typography to highlight critical financial data, making it easily accessible at a glance.

- Incorporating feedback mechanisms, such as loading indicators or confirmation messages, reassure users that their actions are being processed. Venmo, for example, uses animated feedback to show transaction progress, enhancing user confidence in the app’s reliability.

Tools and approaches like wireframing** and prototyping**, using platforms like Sketch or Figma, allow designers to create and test UI concepts efficiently. For instance, Square designers use these tools to iterate on their POS interfaces, ensuring seamless user experiences. Usability and A/B testing help refine design choices based on user feedback and behavior. Robinhood’s iterative testing approach has been key to refining its simple, user-friendly stock trading interface.

Security is a significant concern in fintech, and UI design patterns like biometric authentication and two-factor authentication contribute to safeguarding user data. Specific examples include Face ID in Apple Pay and fingerprint scanning in the N26 app, providing quick and secure access to financial information. By leveraging these design patterns, along with modern design tools and user-centered approaches, fintech companies can build user interfaces that are aesthetically pleasing but also functional and secure, fostering user trust and satisfaction.

Fintech UX Design Patterns

User experience (UX) design patterns are essential in the fintech industry, with financial UX design being a critical element in crafting user-friendly and memorable interfaces for financial applications. These patterns are repeatable solutions to common usability issues, ensuring that fintech products are functional, intuitive, engaging, and trustworthy.

One of fintech’s most critical UX design patterns is the seamless onboarding process. Effective onboarding is vital in fintech apps like Robinhood and Revolut, where new users need to understand and trust the platform quickly. This often involves progressive disclosure, gradually introducing features and functionalities, reducing cognitive load, and enhancing user comprehension.

- Personalization is another important UX design pattern. Fintech apps like Mint and Betterment use data analytics to offer personalized financial advice, investment suggestions, and budgeting tips. This personalization makes the user feel valued and understood, increasing engagement and loyalty.

- Error prevention and recovery are crucial in fintech, where mistakes can have significant consequences. UX design patterns include clear, concise error messages and easy-to-follow recovery steps. For instance, TransferWise (now Wise) uses straightforward language and visual cues to guide users in correcting errors during money transfers, ensuring a smooth user experience.

- Consistency is a key UX design principle, and design systems like Material Design or Apple’s Human Interface Guidelines are often employed to maintain uniformity. Apps like Cash App and Venmo follow these guidelines to ensure their interfaces are familiar and predictable, reducing users’ learning curve.

- Another significant pattern is the use of visual feedback and status indicators. Users must know that their actions are being processed, especially during transactions. PayPal, for example, provides clear visual indicators during payment processing, reassuring users that their transaction is underway.

- Gamification elements can also enhance the user experience by making financial management more engaging. For example, apps like Qapital use gamification techniques to encourage users to save money, set financial goals, and track progress in a fun and interactive way.

- Security and trust are paramount in fintech. UX patterns such as transparent data handling, easy access to security settings, and reassuring language help build trust. The N26 app, for instance, provides detailed insights into security features and allows users to control their security settings easily, fostering a sense of control and safety.

User testing and feedback loops are integral to refining UX design. Continuous testing with real users helps identify pain points and areas for improvement. Companies like Square and PayPal regularly conduct user testing to refine their interfaces, ensuring they meet user needs and expectations.

Multifunctional Products in Wealth Management Fintech Design

In today’s competitive fintech landscape, an application replicating a traditional bank account is insufficient. A well-designed banking app can offer seamless navigation and innovative functionalities, setting new standards in the digital banking space. Users, especially those accustomed to the versatility of neobanks, expect multifunctional products that offer a wide range of features and capabilities. Modern users seek applications that provide a comprehensive suite of financial management tools, all within a single platform.

- Integrated Financial Management. Users want the ability to manage all their finances from one place. This includes connecting multiple bank accounts, credit cards, and investment portfolios. The design should feature a centralized dashboard that provides a holistic view of the user’s financial health with clear visual hierarchies and interactive elements. For example, Revolut and N26 excel in this area by allowing users to view and manage all their financial accounts in one app, providing intuitive navigation and real-time updates.

- Savings and Budgeting Tools. Effective financial management involves more than just tracking expenses. Users seek advanced savings features, such as automatic plans, goal setting, and real-time budgeting tools. The design should include intuitive interfaces for setting savings goals, visual progress indicators, and gamified elements to encourage consistent saving habits. For instance, apps like Yolt and Qapital offer automated savings that round up purchases to the nearest dollar and transfer the difference to a savings account, using engaging graphics to show progress.

- Payment Capabilities. Modern fintech applications need to offer a variety of payment options. Users expect to be able to pay bills, make purchases, and transfer money seamlessly. This includes features like bill splitting, where users can easily divide expenses with friends and pay at restaurants or buy tickets directly through the app. The design should prioritize ease of use, with clear instructions and visual feedback for each transaction type. Venmo and Zelle provide easy ways to split bills and transfer money instantly to friends with a straightforward, user-friendly interface.

- Comprehensive Service Offerings. Beyond basic banking functions, users expect their fintech apps to offer additional services such as investment options, insurance, and financial advice. The design should make these services easily accessible through an organized navigation structure and informative, yet simple, presentation. For example, Wealthfront and Betterment integrate investment management with traditional banking services, providing a one-stop-shop for users’ financial needs with a cohesive and streamlined user experience.

Wealth Management Design Patterns

Wealth management design patterns refer to the design principles and best practices used to create user-friendly and effective wealth management experiences. These patterns help users manage their investments and financial goals efficiently:

- Goal-Based Investing: Wealth management apps should enable users to set and track financial goals, such as saving for retirement or a down payment on a house. This involves providing tools to create, monitor, and adjust goals based on changing circumstances.

- Risk Assessment and Management: Providing users with risk assessment and management tools is essential for informed investment decisions. Apps should offer features that help users understand their risk tolerance and manage their portfolios accordingly.

- Portfolio Diversification: Enabling users to diversify their investment portfolios helps minimize risk and maximize returns. Wealth management apps should provide options and advice on how to spread investments across different asset classes.

- Tax Optimization: Offering tax optimization tools can help users minimize tax liabilities and maximize after-tax returns. This includes features that provide insights into tax-efficient investment strategies and potential tax impacts.

- Financial Planning and Analysis: Providing comprehensive financial planning and analysis tools helps users make informed financial decisions. Wealth management apps should offer features that allow users to analyze their financial situation, plan for the future, and track progress.

By incorporating these design patterns, wealth management apps can provide users with the tools and insights they need to achieve their financial goals, ultimately enhancing their overall financial well-being.

Gamification and Emotional Design for User Engagement in Fintech

Fintech companies increasingly employ gamification and emotional design elements to combat the notion that finance is difficult, boring, and uninteresting. Managing finance can be a challenging and unappealing task for many, leading to the use of creative methods like gamification to enhance user engagement. These strategies make financial management more engaging and enjoyable for users.

- Gamification. Incorporating game-like elements into financial applications can significantly boost user engagement and motivation. Features such as achievements, rewards, leaderboards, and progress tracking turn mundane financial tasks into interactive and enjoyable activities. The design should include visually appealing elements celebrating user achievements and providing motivational feedback. Apps like Step and Monzo use gamification to encourage savings and responsible spending, offering badges for hitting savings goals or maintaining a budget streak.

- Emotional Design. Creating an emotional connection with users through design is another powerful strategy. This involves using visual elements, colors, and narratives that resonate emotionally with users. One effective tactic is using mascots or characters that guide users through the app. These mascots can provide helpful tips, celebrate milestones, and offer encouragement, making the financial journey more personable and less intimidating. For instance, Cleo, a chatbot in the Cleo app, uses humor and a casual tone to help users manage their finances, making the experience more relatable and less stressful.

- Interactive and Visual Elements. Emotional design also involves using engaging visual and interactive elements. Vibrant colors, intuitive animations, and user-friendly interfaces all contribute to a more enjoyable experience. The design should prioritize usability while incorporating playful and engaging elements. Applications like Spendee and You Need A Budget (YNAB) use visually appealing charts and graphs to represent financial data, making it easier for users to understand and manage their finances.

Future Trends in Fintech App Design

Personalization and AI Integration. Fintech applications will increasingly use artificial intelligence (AI) and machine learning to offer personalized experiences. Financial institutions can evolve into well-loved brands by leveraging digital products through white-label platforms, balancing speed and tailored user experiences to foster growth. AI-driven insights will allow apps to tailor financial advice, spending patterns, and investment opportunities to individual users. The design must include dynamic and adaptive interfaces that can present personalized content seamlessly. For instance, predictive analytics might offer custom budgeting tips or investment suggestions based on user behavior.

- Voice and Conversational Interfaces. The rise of voice-activated assistants and chatbots will transform how users interact with fintech applications. Interfaces will need to accommodate voice commands and conversational interactions. This includes designing intuitive voice user interfaces (VUIs) and ensuring that chatbots can handle complex financial queries effectively. Voice interactions will require clear and concise responses, with visual elements complementing voice data for enhanced understanding.

- Biometric Security Enhancements. As security remains a top priority, biometric authentication methods will become more prevalent. Incorporating biometric security features such as facial recognition, fingerprint scanning, and voice authentication will be crucial. These features must be seamlessly integrated into the user interface, providing security and convenience without adding complexity. For example, integrating biometric authentication directly into the login process and transaction approvals will enhance security while maintaining a smooth user experience.

- Augmented Reality (AR) and Virtual Reality (VR) technologies will offer new ways to visualize financial data and conduct transactions. Fintech applications might use AR to overlay financial data in the user’s physical environment or VR to create immersive financial planning experiences. Designers must create intuitive and engaging interfaces for these new mediums, ensuring users can easily interact with their financial information in 3D spaces.

- Blockchain and Decentralized Finance (DeFi). The adoption of blockchain technology and the rise of DeFi platforms will drive new financial products and services. Interfaces for blockchain-based applications and DeFi platforms must be designed to make complex concepts understandable and user-friendly. This includes clear visualizations of blockchain transactions, easy-to-navigate decentralized exchanges, and intuitive wallets for managing digital assets.

- Sustainability and Ethical Design. Increasing awareness of sustainability and ethical considerations will influence fintech design. Fintech applications must incorporate features that promote sustainable financial habits and transparency. This could include carbon footprint tracking for purchases, ethical investment options, and transparent data usage policies. The design should communicate these values clearly to users, building trust and promoting responsible financial behaviors.

- Hyper-Personalized Financial Services. With the proliferation of big data, hyper-personalized financial services tailored to each user’s unique needs will become standard. Hyper-personalization will require advanced data analytics to offer customized financial products and services. The design must support modular and flexible interfaces that adapt to different user segments and preferences, providing a tailored experience for each user.

- Simplification and Minimalism. A continued focus will be on simplifying user interfaces and adopting minimalist design principles. Streamlined interfaces with minimalistic aesthetics will enhance usability and reduce cognitive load. This involves prioritizing essential features, using clean and simple layouts, and eliminating unnecessary elements. The goal is to create intuitive and easy-to-navigate interfaces that allow users to accomplish tasks efficiently.

Bottom Line

Around 72% of users believe personalization is critical for fintech software, and financial companies can enhance user acquisition strategies by focusing on personalized experiences. At Phenomenon, we always prioritize personalization, especially when it comes to fintech apps. Interested in more information? Contact us to learn what factors to consider when designing and developing a banking or any other finance-management app in 2024.

Is your website holding you back? Discover the financial and strategic signs that it is time for a redesign. Learn about ROI, timelines, and growth-driven design.